📷: Manny Villar | FB

By Diego Morra

Former Senator Manny Villar and his entire family deserve not only P12 million in fines for violating the Securities Regulation Code (SRC), the Financial Products and Services Consumer Protection Act and the Revised Corporation Code (RSC). They should serve prison for fraud, for overstating the value of their assets and deluding investors and the people at large into thinking that his Villar Land, formerly Golden MV Holdings, amassed P1.33-trillion in profits last year.

To the credit of the Securities and Exchange Commission (SEC), it has finally woken up from its slumber to investigate Manny Villar, long the nemesis of buyers of housing units who have complained about substandard dwellings, narrow roads and lack of amenities in his subdivisions. On its face, the Villar claim falls since the alleged profits were non-cash, meaning the value was based on the assumed market value for the largely idle, non-developed lands in Villar City, which is purported to be comprised of 3,500 hectares. Villar Land is not even liquid, so how could it claim to have earned P1.330-trillion as its properties have bombed and investors are shying away from anything associated with the Villars?

Aware of the fraudulent character of the claim, any auditor worth his ledger would squirm and not lend his John Hancock to the Villar claim, which is exactly what happened when Villar’s own external auditor, Punongbayan & Araullo (P&A) shot down tycoon Manny Villar Jr.’s galactic revaluation in Villar City, and, after being cornered, Villar Land erased over P1.33 trillion in paper gains for 2024. Manny Villar has succumbed to his own “chicharon” about being the country’s wealthiest oligarch, a businessman who failed to scrounge around for P500-million during the Estrada administration to finance his mall ventures. The Villar boast will now crash to the ground the way the dirigible Hindenburg exploded and crashed,

Apart from finding out that the Villars deliberately overstated the value of their assets, the SEC should now consider banning Villar Land from listing with the Philippine Stock Exchange (PSE) for material misrepresentations, fudged statistics and dubious valuations. It is pretty obvious that Manny Villar boosted the values of his assets in the same manner that Donald Trump overstated the price of his New York penthouse by multiplying its size by 300%. Villar “bought” properties owned by three other affiliated companies for only P5.2 billion to compete with his contemplated Villar City and then worked to revalue the largely idle lands to cosmic levels. This is akin to the demented claim of Trump that he sets the values of his properties, not the market, not the appraisers, not the accountants and certainly not the US government.

Call it quantum entanglement, but the Trump mindset has been entwined with Villar’s gray matter, an indication that both are accomplished speculators. Manny Villar apparently thought that he could get away with the weird land valuations, as if putting the Villar tag on raw land would magically raise its price. The SEC chief was not born yesterday, and neither were the skeptical markets who have witnessed how the Villars used political power to make expressways wind through their properties to boost their prices and redesign other infrastructure projects to end up in their so-called Villar City. Former Senator Cynthia Villar, also slammed reclamation projects that threatened her fiefdom, donning the hat of an environmental champion to criticize those projects since they would also steal part of the market for the Villar kingdom in Las Pinas, Paranaque and a part of Cavite.

With their debacle at the SEC, the Villars will now find it hard to convince Forbes and other foreign business magazines to take the claim of Manny Villar hook, line and sinker that he is, indeed the wealthiest Filipino alive. The slashing of the value of the Villar Land properties sends a signal to the domestic and foreign property developers that they have been taken in for a ride by Manny Villar, whose net worth went south, affected principally by the suspension of the trading of Villar shares at the bourse. Yet, the market still has to learn more about the business tactics of Villar, who was able to push road construction projects leading to his socialized housing projects in eastern Rizal notorious for their roads with 1-1/2 lanes, and take over irrigated lands in Iloilo obviously reserved for agrarian reform beneficiaries (ARBs).

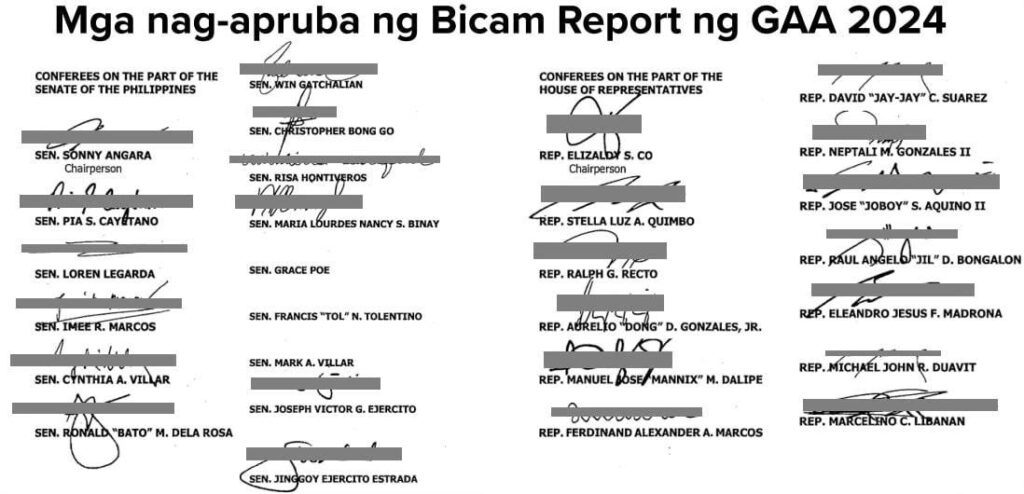

There are many reports of Villar’s joint ventures that bombed or got stalled, with the partners reportedly not being paid in full up front, and others reduced to selling condos and office units for them to get paid. The argument is plainly duplicitous: A partner shares the risks, even if the “partner” happens to be the seller, whether the partner is an individual, a juridical person or even a religious organization, perhaps a church with properties in highly urbanized areas. It is now time for the SEC to order an intensive investigation into Villar Land, its affiliates and subsidiaries, as well as its many projects that have made short shrift of the agrarian reform law, contravened the idea of water districts being the under the control of local governments, with oversight by consumers. With the SEC ruling slapping fines on Manny Villar, Sens. Mark Villar and Camille Villar as well as Villar Land executives implemented, the share value of the company that last traded on May 15. 2025 is expected to sink from its peak of P2,296. At that price, the company was valued at P1.48 trillion, putting it on top of the heap of all other conglomerates in the Philippines. It turns out that the share was not worth that much.

Neither was there any basis for Villar Land to declare a record P999.72 billion profit last year, which was 68,000% higher than that of 2023. Falling revenues and operating income cannot account for the clearly dubious financial claims that Villar Land made. Sen. Mark Villar will most likely be grilled for “ghost” flood control projects when he was the secretary of the Department of Public Works and Highways (DPWH) during the unlamented Rodrigo Duterte administration. Worse, he will also contend with accusations of self-dealing since the DPWH also took over the supervision of more than 500 water districts during his incumbency. Under his stewardship of DPWH, the Villar-owned Primewater ended up controlling more than 300 water districts nationwide. What goes around comes around. Or as the Russians would joke: “Remember, Comrade, don’t skin the chickens before the bear hatches.”